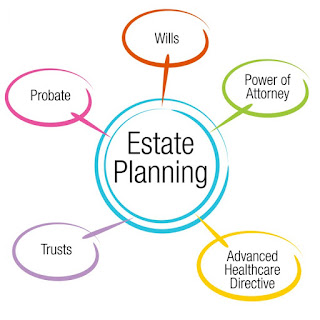

Summary: The sum of your

estate is much more than just your real estate, financial accounts and other

large assets. It also includes many items without ownership titles or deeds

that may hold great financial worth or sentimental value. Regardless of an item’s

dollar value, if it is important to you, you will want to make sure that it is

addressed in your estate plan. With a proper set of estate planning documents

with complete instructions in them, both you and the person you’ve selected to

manage your estate after your death can have the peace of mind of knowing that

the things that mattered to you will go to the people you wanted to receive

them.

This time of year is

often called the “season of giving.” People seek to bring joy to loved ones by

giving presents they love. One variety of such gift might be a new addition to

a favorite collection of items, or perhaps a beautiful antique. As you consider

your holiday gift-giving ideas this season, it is worth your while to remember

that few gifts are more powerful than a gift left to a loved one in your

estate. With that in mind, it is worthwhile to take time to make sure that your

valuables are properly planned for in the event of your death.

Items of personal

property can be easy to overlook sometimes while addressing estate planning, as

one focuses on dealing with large items such as homes, vehicles and financial

accounts. However, these smaller items often hold great value (whether

monetary, sentimental or both,) so it is important to plan for them, especially

to ensure that they pass to the person who will cherish them as much as you

have.

|

If your estate plan

includes a revocable living trust, planning for these assets works a little

different than your large assets. Whereas you house, car or bank account can be

funded into your trust by transferring their deeds/titles of ownership over to

the name of your trust, funding items that do not have title documents (which

can include the family silverware/china to jewelry to antiques) is accomplished

using something called “Schedule A.” Schedule A is part of your trust where you

list specific items that you are transferring into your trust.

Of course, the use of

your Schedule A is not limited to antiques, collectibles or keepsakes. You can

also use it to transfer many household items, such as furnishings or

electronics (for example, a computer or furniture.) It is important to make

sure that you update your Schedule A regularly to make sure that its list of

contents is up-to-date and reflects everything without titles that you want to

distribute through your trust.

|

| Legacy Assurance Plan For Revocable Living Trust |

Once you’ve fully filled

out your Schedule A, the next step for planning for these assets works much the

same as if you have a plan that uses a will as the main document for distributing

your assets. You simply include a specific paragraph (or paragraphs) stating

whom you want to receive each of these assets. As with Schedule A, it is

important to make sure to review this part of your plan routinely to make

certain that want is in your plan documents reflects what your current goals

are.

This article is published by the Legacy Assurance Plan

and is intended for general informational purposes only. Some information may

not apply to your situation. It does not, nor is it intended, to constitute

legal advice. You should consult with an attorney regarding any specific

questions about probate, living probate or other estate planning matters.

Legacy Assurance Plan is an estate planning services-company and is not a

lawyer or law firm and is not engaged in the practice of law. For more

information about this and other estate planning matters visit our website

at www.legacyassuranceplan.com.

This article written and

published by:

8039 Cooper Creek Blvd

University Park, Florida 34201

844.306.5272 (Phone)

No comments:

Post a Comment