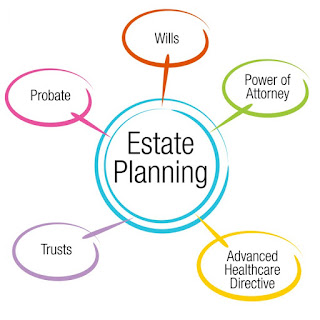

Summary: For many, our moral and ethical views are some of the strongest

perspectives we hold. Your estate plan is one method for living your faith

and/or values. Trusts can possibly provide significant benefits as you use your

estate plan to aid a person or entity in the furtherance of a religious or

charitable mission. You can ensure that your end of life decisions reflect your

values by careful planning with regard to your living will and healthcare power

of attorney.

The decisions you make in your estate plan are a part of the reflection

of who you are. One way to demonstrate your values is through estate planning.

These decisions can go well beyond just remembering a values-based charity in

the distribution of your assets, but can impact a wide range of elements of

your plan.

One straightforward way to bestow this benefit is through including a

distribution in your will or living trust that goes directly to the cause of

your choice. You might choose to help a church, a church-connected charitable

organization or a religious educational institution. Others might prefer to

demonstrate their values by benefiting a philanthropic entity that is not tied

to any religious organization.

However, you also have other options available, as well. Special trusts,

called charitable remainder trusts and charitable lead trusts, may allow you to

further the cause of your favorite religious or secular charity while also

reducing your tax obligations. Charitable lead trusts can lower your current

taxable income, while charitable remainder trusts can lower your potential

capital gains tax obligations. For this reason, a charitable remainder trust

may be especially useful if you have a charity you wish to aid and you have

assets that have appreciated substantially since you bought them (such as real

estate or stocks.) It is important that the IRS recognize the charity your wish

to benefit, otherwise you may lose the tax-related benefits of your trust.

There are other ways to reflect your values in your plan. You can make some

(or all) of the distributions from your living trust or will conditional on the

beneficiary making certain choices or acting in a way consistent with your

values. For example, you could make a cash distribution to a loved one

conditional or his/her pursuing a religious education or you could distribute a

piece of real estate to a beneficiary on the condition that the property be

used only for the furtherance of a religious mission. You can also instruct

that beneficiaries not use the assets they receive from you for anything that

contradicts your values. Utilization of an incentive trust (or trusts) may be

helpful if you want to incorporate such goals into your plan.

Finally, if you have strong views, based in your religious or ethical

foundations, regarding end of life decisions, it is important to plan for those

positions to be followed. You should communicate your preferences to your

estate planning attorney and your loved ones, and when choosing an agent to act

on your behalf under the power of your living will or healthcare power of

attorney, you should strongly consider selecting someone who shares your

perspectives and values regarding end of life decisions.

This article is

published by the Legacy Assurance Plan and is intended for general informational

purposes only. Some information may not apply to your situation. It does not,

nor is it intended, to constitute legal advice. You should consult with an

attorney regarding any specific questions about probate, living probate or

other estate planning matters. Legacy Assurance Plan is an estate planning

services-company and is not a lawyer or law firm and is not engaged in the

practice of law. For more information about this and other estate planning

matters visit our website at www.legacyassuranceplan.com.

This article written and

published by:

8039 Cooper Creek Blvd

University Park, Florida

34201

844.306.5272 (Phone)

info@legacyassuranceplan.com (email)